Determining and Applying Benefits

There are several common COB situations, including VSP primary to another carrier, multiple VSP plans, health plan or Medicare with VSP coverage, routine versus medical services, and VSP secondary to another vision carrier. This section includes guidelines for coordinating benefits for your VSP patients.

Administering Coordination of Benefits

Use the following to assist your patient in maximizing the eyecare benefits (vision or medical).

- Based on your professional judgment, determine if the service is routine or medical.

- Determine the primary and secondary plans.

- Verify eligibility and available services under each plan.

- Determine patient responsibility, based on primary insurance.

- Submit the primary and secondary claims, following the appropriate Submitting Claim instructions.

- Apply total COB secondary allowance, less any secondary copays, to patient's total primary out-of-pocket expense. Patient pays remaining balance, but not more than the allowed amount.

Determining Primary and Secondary Plans

Review the scenarios below to help determine your patient’s primary and secondary plans, if your patient is covered under multiple plans and isn’t a dependent child. If none of the scenarios fit, the plan that’s covered your patient longest is primary.

|

Patient has |

and |

then |

|---|---|---|

|

VSP coverage |

the spouse has non-VSP coverage |

the patient’s VSP plan is primary. |

|

VSP coverage |

the spouse has VSP coverage |

the patient’s VSP plan is primary. |

|

non-VSP coverage |

the spouse has VSP coverage |

the patient’s non-VSP plan is primary. The spouse’s VSP plan is secondary. |

|

VSP and non-VSP coverage |

none of the Coordination of Benefits Rules listed below apply |

the plan covering your patient longest is primary* |

|

Medicaid coverage through VSP |

has other coverage (through a health plan or Medicare) |

Medicare or the other coverage is primary. The VSP Medicaid plan is secondary |

|

one or more VSP plans |

is not eligible for Medicare |

the plan covering your patient longest is primary* |

|

VSP coverage as an active employee |

VSP coverage as a retiree under another VSP plan |

the active employee VSP plan is primary. The VSP retiree plan is secondary. |

|

COBRA coverage (a continuation plan) |

is active with another plan as an employee or dependent |

the active employee or dependent VSP plan is primary. The COBRA VSP plan is secondary. |

|

VSP coverage as a retiree |

is active under a COBRA plan |

the COBRA plan is primary. The retiree plan is secondary. |

|

VSP coverage as a dependent of a retired employee |

is an active employee in another VSP plan |

the plan covering the patient as an active employee is primary. The VSP plan covering the patient as a dependent is secondary. |

|

VSP or non-VSP coverage through self or spouse |

is covered under parents’ plan |

patient’s or spouse’s plan is primary. Parents’ plan is secondary. |

Use the following chart if your patient is a dependent child with VSP coverage as primary and secondary.

|

Patient is |

and |

then |

|---|---|---|

|

dependent child |

the parents are NOT separated or divorced |

The plan of the parent whose birthday is first in the year is primary* If both parents have the same birthday, the plan that’s covered a parent longer is primary* If the other plan doesn’t have a birthday rule, the gender rule applies (the father’s plan is primary). |

|

dependent child |

the parents ARE separated or divorced with NO court decree |

the custodial parent’s plan is primary* The plan of the custodial parent’s spouse (if any) is secondary. Followed by the plan of the non-custodial parent, and then the plan of the non-custodial parent’s spouse. |

|

dependent child |

the parents ARE separated or divorced WITH a court decree |

the plan decreed by the court as primary is primary* If the decree states both parents have joint custody without stating who’s responsible for healthcare expenses, follow the birthday rule. |

*Important!

Obtain the length of coverage or custody information from your patient or member. Parental custody information may apply when determining coverage for a child.

Applying Benefits

VSP primary to another carrier

When a VSP plan is primary, apply benefits as you would in the absence of any other plan. If needed, call VSP at 800.615.1883 to request a letter detailing your patient’s out-of-pocket expenses that can be shared with the secondary insurer.

Quick Tip:

If your patient isn’t eligible for a service under the primary plan, the secondary plan may be used as primary for that service.

Multiple VSP plans for routine services:

- Determine the primary and secondary plans.

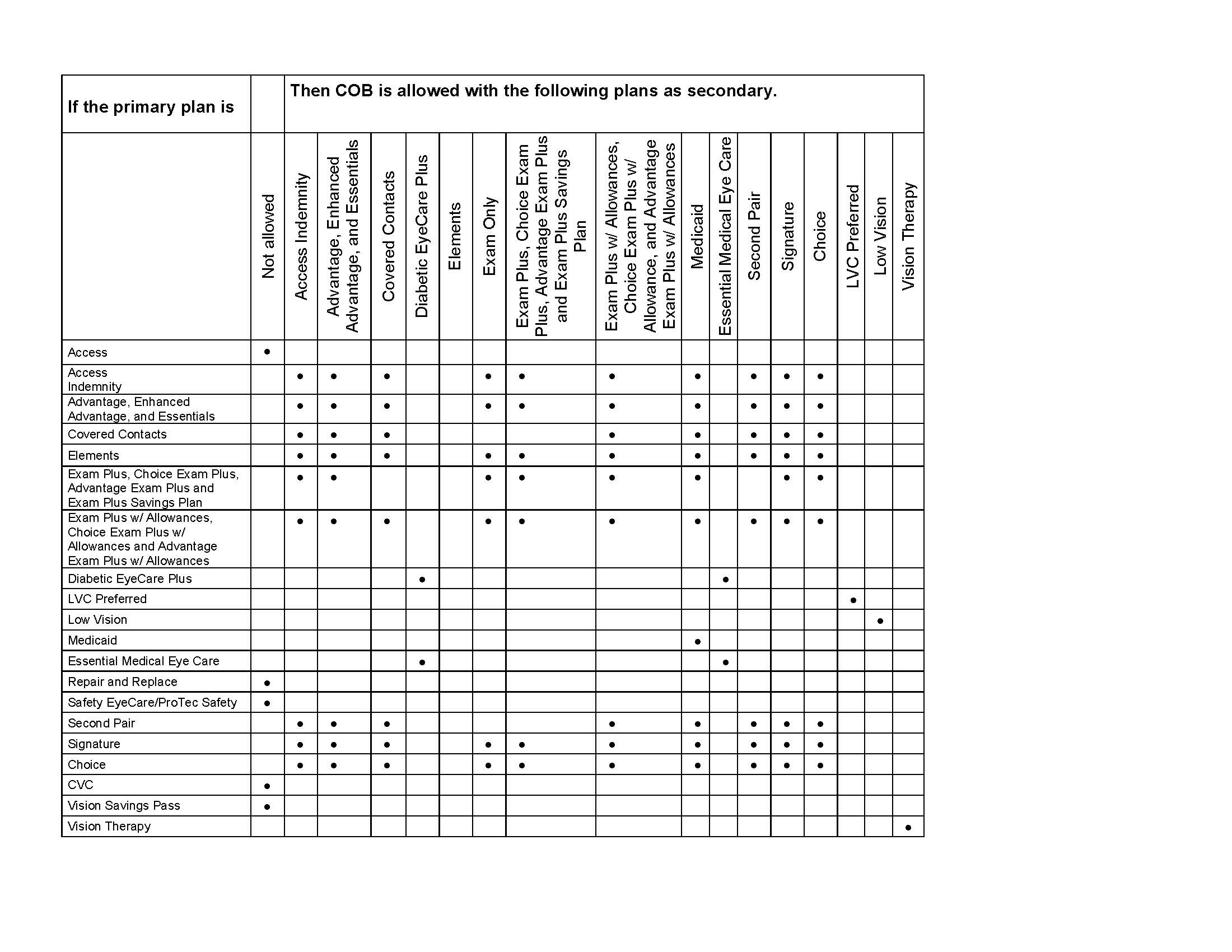

- Review Coordination of Benefits between Multiple VSP Plans to verify VSP plans can coordinate.

- Verify eligibility and if any services are exhausted under either plan.

Quick Tip:

If your patient isn’t eligible for a service under the primary plan, the secondary plan may be used as primary for that service.

4. Determine the patient’s out-of-pocket expenses from the primary plan.

5. Refer to the Secondary Allowances schedule to determine the COB amount for each service payable under the primary plan that is also available under the secondary plan.

Quick Tip:

Be sure to review COB rules on primary and secondary authorizations prior to calculating COB secondary allowance.

6. Deduct total available COB secondary allowance from patient’s total primary out-of-pocket expense. Patient pays remaining balance.

Quick Tip:

You can also access the COB Calculator on VSPOnline to help determine the amounts a patient can coordinate for routine services when VSP is secondary.

7. Bill VSP using the primary plan authorization number and reference the secondary plan’s authorization. See Submitting COB Claims for detailed instructions.

When a VSP plan is secondary, follow these steps: 1. Verify eligibility and if any services are exhausted under either plan.

Quick Tip:

If your patient isn’t eligible for a service under the primary plan, the secondary plan may be used as primary for that service.

2. Determine whether your patient is eligible for benefits under the secondary plan

3. Refer to the Secondary Allowances schedule to determine the COB amount for each service payable under the primary plan that is also available under the secondary plan.

4. Deduct total available COB secondary allowance from patient’s total primary out-of-pocket expense. Patient pays remaining balance, but not more than the allowed amount.

Quick Tip:

You can also access the COB Calculator on VSPOnline to help determine the amounts a patient can coordinate for routine services when VSP is secondary.

5. Bill VSP as secondary. See Submitting COB Claims for detailed instructions.

Members may have coverage under both VSP and a health plan or Medicare.

Common scenarios:

- If you participate on the patient’s health plan and the exam is medical, bill the health plan or Medicare as primary.

- If the exam is routine, bill VSP as primary unless the patient has routine coverage through their health plan*

- If the health plan covers the exam only, submit the exam claim to the health plan as primary and the materials claim to VSP as primary.

Quick Tip:

Be sure to obtain two separate authorizations – one to submit your exam to coordinate benefits and one to submit the materials to VSP as primary.

Medical plans generally have higher copays than VSP and may have deductibles. They also don’t typically cover a refraction. To save money for your patient, coordinate benefits with VSP to help cover unpaid portions of the medical eye exams, if any, including the refraction and other medical services. Plus, you now have options to help maximize your patient’s plan.

- If another insurance carrier is primary to VSP, you can now coordinate both their routine and medical benefits (i.e. medical exam and refraction using a WellVision exam benefit and Essential Medical Eye Care) – a medical and refractive diagnosis is required.

Quick Tip:

Be sure to include applicable medical diagnosis codes for the eye exam and any medical procedures with a routine diagnosis code for the refraction.

*Patients covered under the Federal Employees Dental and Vision Insurance Program may have routine coverage through their health plan. For more information, check the Federal Government Client Details in the Choice Network Manual.

Common Scenarios: Routine vs. Medical Services

| Description |

Eligible VSP |

Billing |

|---|---|---|

|

Patient comes in for routine exam and is also seen for a medical eye issue. Provider determines chief complaint is medical. Refraction is performed with medical and refractive diagnosis. Member has coverage through a health plan or Medicare. Has both a WellVision and VSP medical benefit (i.e., Essential Medical Eye Care). |

Medical and WellVision |

Bill the health plan or Medicare as primary (if on their panel). Use VSP’s medical plan (i.e., Essential Medical Eye Care) as the secondary VSP benefit to coordinate benefits for medical exam (and any medical procedures). AND add the WellVision exam authorization in the COB Secondary Authorization field if a refractive diagnosis code is billed to pay toward the refraction. |

|

Patient comes in for routine exam and is also seen for a medical eye issue. Provider determines chief complaint is medical. Refraction is performed with medical diagnosis, no refractive diagnosis. Member has coverage through a health plan or Medicare. Has a VSP medical benefit (i.e., Essential Medical Eye Care). Member is not eligible for WellVision exam. |

Medical only |

Bill the health plan or Medicare as primary. Use VSP’s medical plan as secondary benefit for the medical exam, refraction will be denied. Submit claim electronically, keep copy of EOP in patient chart. |

|

Patient comes in for routine exam and is also seen for a medical eye issue. Provider determines chief complaint is medical. Refraction is performed with medical and refractive diagnosis. Member has coverage through a health plan or Medicare. Has a VSP WellVision exam benefit (no VSP supplemental medical coverage). |

WellVision |

Bill the health plan or Medicare as primary. Use WellVision as the secondary VSP benefit to coordinate benefits if refractive diagnosis code is billed, including refraction. Submit claim electronically, keep copy of EOP in patient chart. |

|

Patient comes in for routine exam and a medical condition is identified. Provider performs medical exam. Refraction is performed with medical diagnosis, refractive diagnosis. Member has coverage through a health plan or Medicare AND two VSP plans with WellVision and medical eyecare plan (i.e., Essential Medical Eye Care). |

Medical only |

Determine primary VSP plan. Bill VSP under the primary plan’s Essential Medical Eye Care/DEP Plus claim electronically with the secondary authorization to coordinate benefits. Use Essential Medical Eye Care as the secondary VSP benefit for medical only exam, refraction will be denied. |

Coordination of Benefits between Multiple VSP Plans

Important!

The primary and secondary plans must be under different ID numbers or different clients, unless there are special comments, or if COB rule 11 applies.

Interim benefits are not available for coordination under any plan benefit type whether considered primary or secondary.

If another insurance carrier is primary to VSP, you can now coordinate both their routine and medical benefits (i.e. medical exam and refraction using a WellVision exam benefit and Essential Medical Eye Care) – a medical and refractive diagnosis is required.

Note:

If your patients have plano coverage available on the primary benefit, they must have plano coverage available on the secondary benefit to coordinate both plans when receiving plano materials.